Banking Sector is currently undergoing merger phase with several banks merging in the recent times, while reporting decent Q1FY23 performance

4 min read

“The Q1FY23 operating performance of banks under our coverage demonstrated an upbeat stance on advance growth and credit cost outlook. Nonetheless, reported earnin

gs missed our expectations due to MTM hit and elevated Opex. NIMs just stayed put (as against expectations of improvement) as upward repricing of EBLR/MCLR loans will likely take 3-6 months reset period.” As said ICICI Securities for Banking sector in its report.

Further, it can be said that several significant banks in the sector have seen around 16% YoY & 2% QoQ growth in NII. Their core operating profit grew 17% YoY, while treasury loss dragged operating profit lower by 13% YoY and 18% QoQ. Whereas subsiding credit cost and lower base supported 35% YoY earnings growth. Earnings of SBI, HDFC Bank and Kotak lagged investors expectations. Yet they still came out to be robust, keeping in the mind global recessionary fears & falling of rupee value. As the situation still seems to be improving, Bank Nifty has also broken one of their past resistances. It has made a robust up move post Q1FY23.

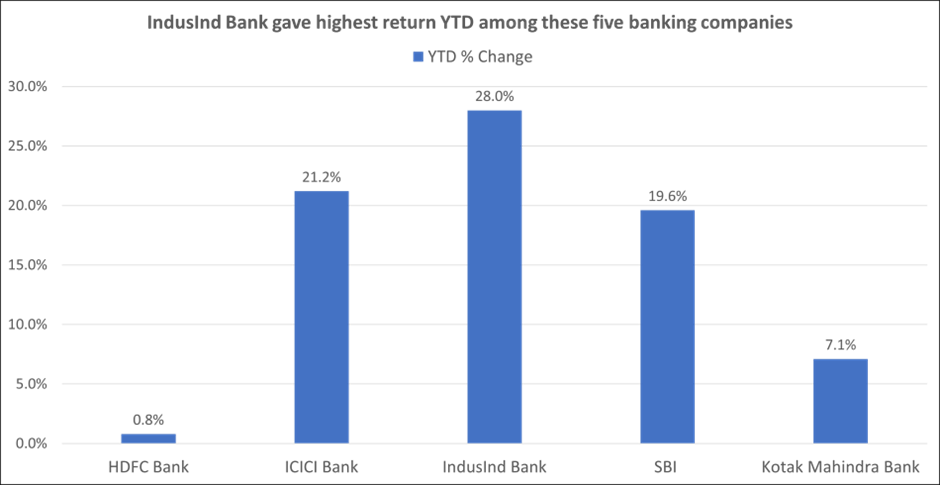

While few appears to be laggards in the race of Q1FY23 results & YTD returns, IndusInd Bank & ICICI Bank seems to be leaders. IndusInd Bank and ICICI Bank, both gave robust above 20% return YTD. While SBI also gave almost 20% returns, Kotak Mahindra and HDFC Bank seems to be the last in the race.

Now, as NIFTY50 is trading near 18,000 levels. Analysts are expecting it to make a new high, by crossing the resistance with high volumes. Let’s check how the sentiment plays for the banking sector. We will now analyse quarterly performance of these five banks mentioned in the graph above. This will help us understand the performance of Bank sector in Q1FY23 and prospects going forward.

Banking Sector results:

The performance of IndusInd Bank in Q1FY23 reaffirmed the broker’s confidence in its being able to deliver >5% PPoP/loans (Pre provision operating profits). It gave 1.7%/1.9% RoAs and 15%/16% RoEs by FY23E/FY24E, respectively. Their NII was up 15.8% YoY, 3.5% QoQ to Rs 4125 crore on the back driven by robust growth in business. Sequentially margins remained flat at 4.21% (up 15 bps YoY). Other income was up 8.3% YoY to Rs 1929 crore. This was driven by healthy growth of 47% and 9% YoY & QoQ respectively, in core fee income at Rs 1932 crore.

HDFC’s NII was up 14.5% YoY and 3.2% QoQ to Rs 19481 crore aided by healthy loan growth of 21.6% YoY and stable NIMs at 4.0% on a sequential basis. Other income declined 16.4% QoQ and showed modest 1.6% growth on yearly basis mainly on account of treasury loss of Rs 1312 crore vs. a gain of Rs 601 YoY. Fee income reported strong growth of 38% YoY.

ICICI Bank as it is well-placed to optimally invest in building new growth runways, however, incrementally enhancing medium term return ratios appears a steep ask. ICICI’s NII growth (+21% YoY), led by stable NIMs (4%). Loan growth was balanced across portfolios as the quarter witnessed improved utilisations and Capex activity in underlying wholesale lending (+17% YoY), while retail was led by mortgage (+22%), business banking (+45%) and credit cards (+63%).

For rest of Banks in the sector

SBI’s operational performance was below estimates with NII growth at 12.9% YoY and flat QoQ to Rs 31,196 crores. This was due to lower NIMs (13 bps decline QoQ). Other income was impacted significantly due to MTM loss. It came in at Rs 2312 crore, 5x lower compared with Q1FY22 and Q4FY22. `

Kotak Mahindra’s posted a healthy growth in NII at 19.2% YoY and 3.9% QoQ to Rs 4697 crore. Healthy NII growth was aided by 14 bps sequential expansion in NIMs to 4.92% and robust growth in advances. Other income was down 8% YoY and 31.9% QoQ to Rs 1243 crore, mainly due to lower trading income. Fee income grew 41.7% YoY but declined 2.4% on QoQ basis.

Other key Updates of Banking Sector:

HDFC bank and HDFC ltd has already announced a mega merger. This is expected to be completed in next 14-16 months.

Another news in the similar lines is the merger talks about Kotak Mahindra bank and Federal Bank. While the Federal Bank MD & CEO denied the claim in an interview with media. He said that they may probably acquire some other entity. Few investors are considering this as a speculative move and betting on the same. So, it would be interesting to see what happens in the ever-growing future.

Our View:

As Banks have already seen several ups and downs from the beginning of 2022 with RBI hiking benchmark rates repeatedly in 2022 with a move to control the inflation. Several banks have also seen improvement in margins in Q1FY23, while others are still struggling. As the future prospects appear to be in favour of banks with growing CASA and other indicators, recessionary fears are still a hurdle.

Therefore, long term investors can consider investing in Mid cap and large cap banks having robust fundamentals including ICICI Bank, Kotak Mahindra Bank and HDFC Bank going forward. A long-term investing bet appears to be reasonable as NIFTY is already testing its resistance to make a new high and economy recovering from covid havoc appears to be few factors favouring their growth.

Also read –